Investing can seem daunting, but with the right knowledge and approach, it can be a powerful tool to build your financial future. This guide provides a foundational understanding to help you get started.

Understanding Your Financial Goals

Before diving into specific investment strategies, it’s crucial to define your financial goals. Are you saving for retirement, a down payment on a house, or your child’s education? Understanding your objectives—short-term versus long-term—will help you choose the most suitable investments. Consider using a financial planning tool to help visualize your goals. Learn more about setting financial goals.

Asset Allocation: Diversifying Your Portfolio

Diversification is key to mitigating risk. Don’t put all your eggs in one basket! A well-diversified portfolio includes a mix of asset classes, such as stocks, bonds, and real estate. The ideal allocation depends on your risk tolerance and time horizon.  For example, younger investors with a longer time horizon can generally tolerate more risk and allocate a larger portion of their portfolio to stocks. Check out this asset allocation calculator.

For example, younger investors with a longer time horizon can generally tolerate more risk and allocate a larger portion of their portfolio to stocks. Check out this asset allocation calculator.

Investing in Stocks: Equity and Growth

Stocks represent ownership in a company. Investing in stocks offers the potential for higher returns than other asset classes, but it also carries higher risk. There are various ways to invest in stocks, including individual stocks, mutual funds, and exchange-traded funds (ETFs). Understanding the difference between value and growth stocks is essential.  It’s important to research thoroughly before investing in any individual company. Consider consulting a financial advisor for personalized guidance. Learn more about stock market investing.

It’s important to research thoroughly before investing in any individual company. Consider consulting a financial advisor for personalized guidance. Learn more about stock market investing.

Investing in Bonds: Fixed Income and Stability

Bonds are essentially loans you make to a government or corporation. They offer a fixed income stream and are generally considered less risky than stocks. However, they typically offer lower returns. Bonds can play a vital role in balancing your portfolio and providing stability. Different types of bonds exist, each with its own risk and reward profile. Explore different bond options here.

The Role of Real Estate in Your Portfolio

Real estate can be another valuable addition to a diversified investment portfolio. This could involve directly purchasing properties or investing in real estate investment trusts (REITs). Real estate can offer both income (through rent) and potential appreciation in value. However, it’s important to understand the associated costs and risks involved. [IMAGE_3_HERE] This is a more hands-on investment type than stocks and bonds.

Staying Informed and Adapting Your Strategy

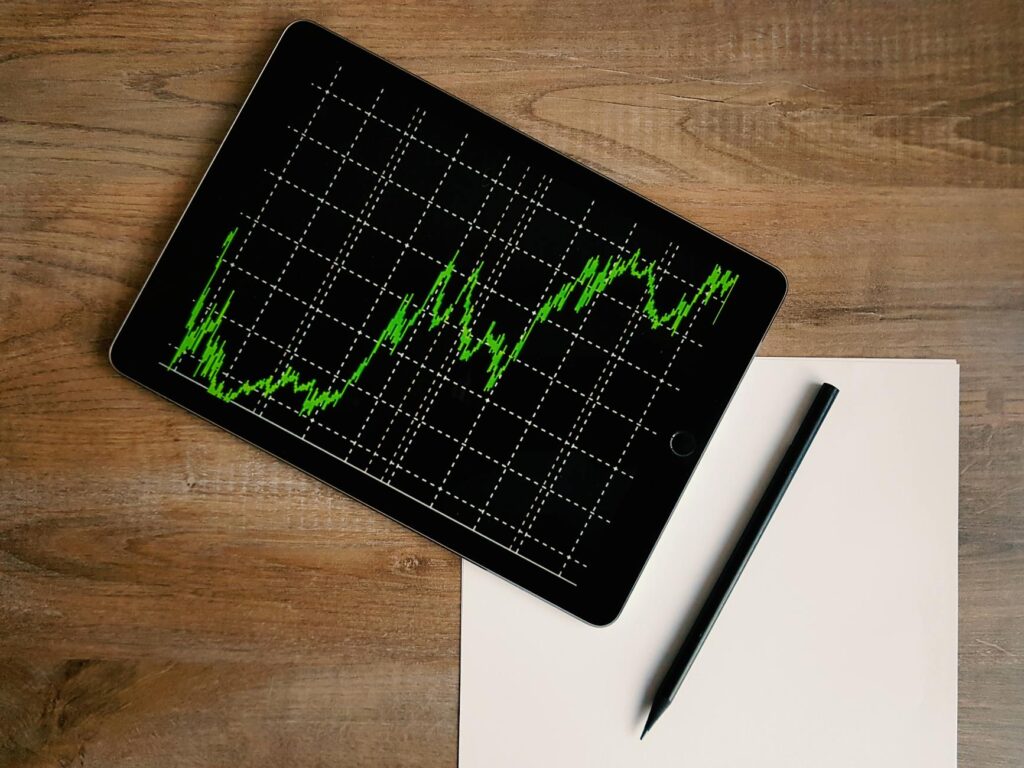

The investment landscape is constantly evolving. Staying informed about market trends, economic indicators, and geopolitical events is critical for making sound investment decisions. Regularly review and adjust your portfolio based on your changing circumstances and market conditions. Stay updated with market news here.

Investing requires careful planning, research, and a long-term perspective. While it carries risks, the potential rewards make it a worthwhile endeavor for building a secure financial future. Remember to seek professional advice when needed.

Frequently Asked Questions

What is the best investment strategy? There’s no one-size-fits-all answer. The best strategy depends on your individual financial goals, risk tolerance, and time horizon. It’s wise to consult with a financial advisor to determine what’s right for you.

How much money do I need to start investing? You can start with as little as a few dollars through many online brokerage accounts. However, it’s generally recommended to have an emergency fund before investing.

What are the risks involved in investing? All investments carry some degree of risk. Stocks, for example, can experience significant price fluctuations. It’s crucial to diversify your portfolio and understand the risks associated with each investment before making a decision.

How often should I review my investment portfolio? It’s a good idea to review your portfolio at least once a year, or more frequently if there are significant changes in your financial situation or the market.

Where can I learn more about investing? There are numerous resources available, including books, websites, and courses. Consider seeking advice from a qualified financial advisor.